Microsoft Dynamics 365 Finance

Maximize financial visibility and control

CFOs and finance teams in large enterprises and global companies navigate challenges driven by economic volatility, digital transformation, regulatory complexity and evolving business models. The need to maintain financial stability, optimize costs and profitability, comply with regulations and security needs while ensuring transparency is a strategic imperative.

Reducing complexity, making the right decisions and making use of innovation is supported by a centralized financial management solution that aligns processes and people across the supply chain.

What is Dynamics 365 Finance?

Microsoft Dynamics 365 Finance (built on the previous Dynamics 365 Finance and Operations platform) is a cloud-based enterprise resource planning (ERP) software designed to help organizations manage their financial operations efficiently. Comprehensive and innovative features across financial planning, accounting, reporting, insights and financial processes automation drive business growth.

BENEFITS – Microsoft Dynamics 365 Finance

An Innovative Platform to Drive Efficiency

Automate and modernize your global financial operations with Dynamics 365 Finance. Reduce manual financial processes to improve efficiency. Monitor performance in real time, predict future outcomes and make data-driven decisions with AI-powered finance analytics to drive business growth

Scalable, Secure and Integrated

Suitable for growing businesses with complex financial needs, Dynamics 365 Finance works seamlessly with other business applications such as Microsoft Dynamics 365, Microsoft 365 and third-party software for a unified ecosystem. Microsoft’s cloud infrastructure ensures data security and compliance.

CAPABILITIES – Microsoft Dynamics 365 Finance

Financial Management and Accounting

Microsoft Dynamics 365 Finance provides comprehensive financial management capabilities including General Ledger, Accounts payable, Accounts Receivable and Fixed Assets.

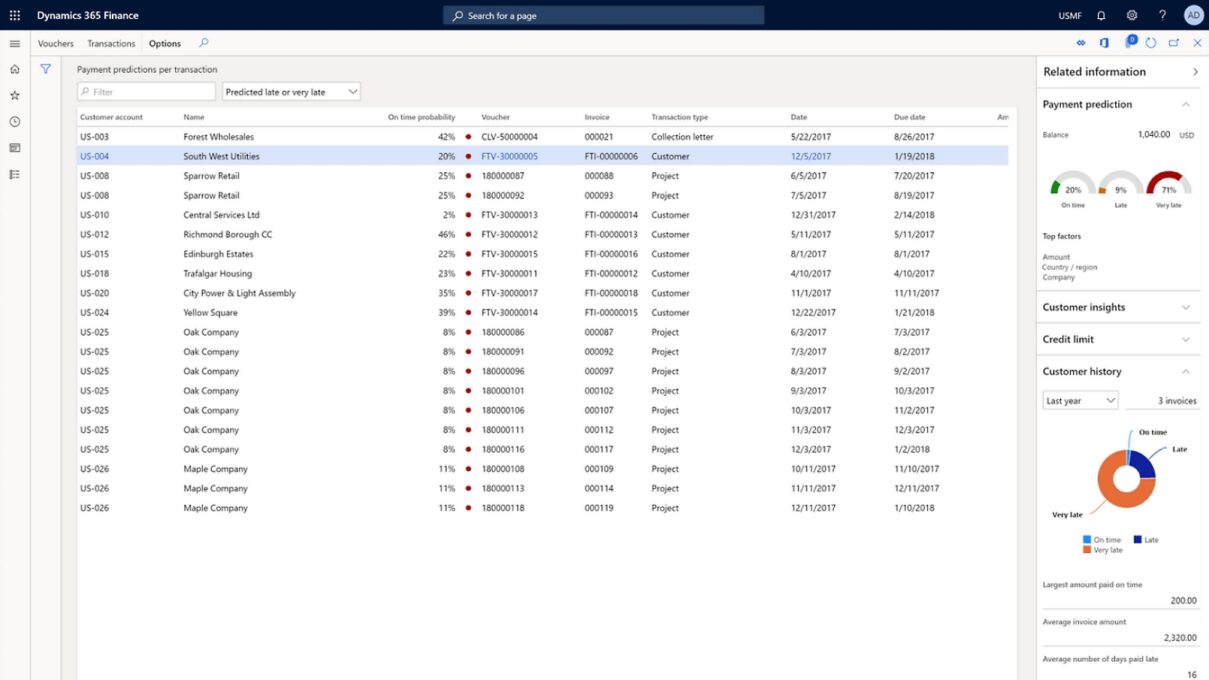

Machine learning predictive recommendations and proactive guidance for timely customer payments.

Reduce operational expenses with financial process automation, budget cost control, automated invoice processing and payment management.

Multi-currency and multi-entity features support global and multi-site operations for transparency, simplicity and compliance across the business.

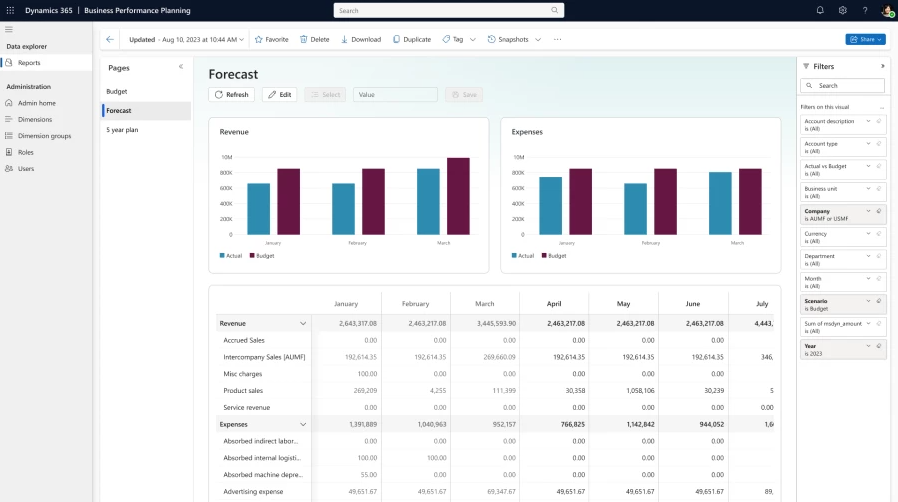

Budgeting and Forecasting

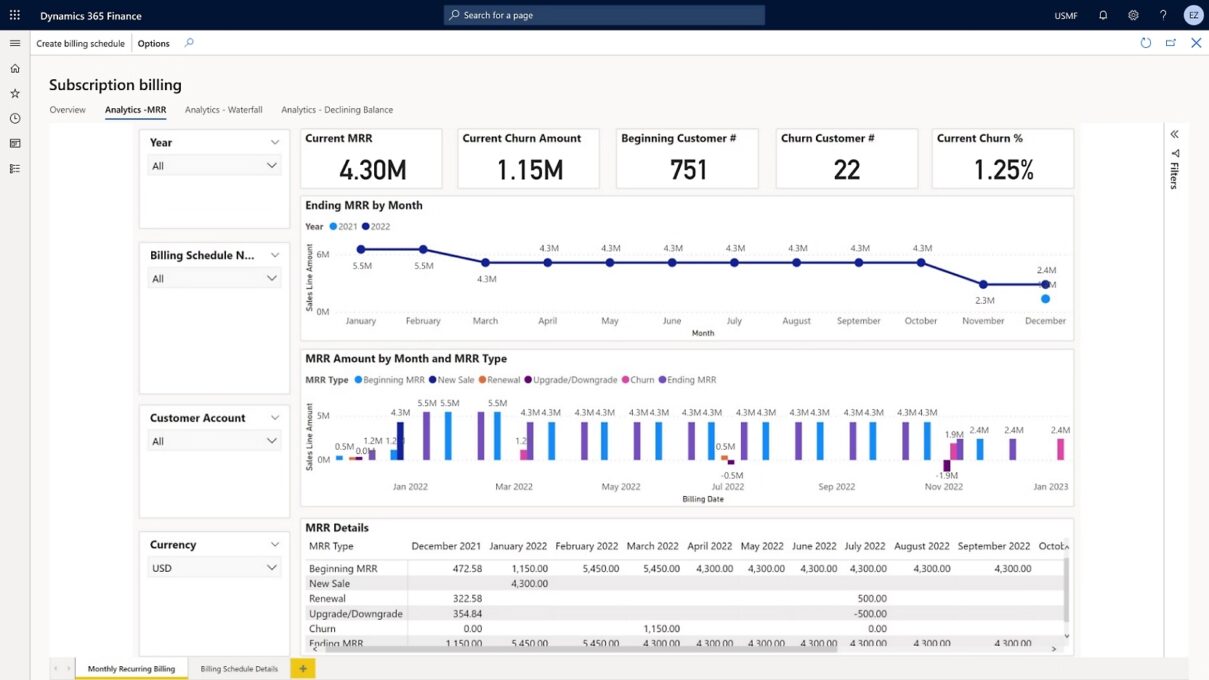

Budgeting and Forecasting features are essential for financial planning, ensuring organizations can manage resources efficiently, control expenses and predict future financial performance. Microsoft Dynamics 365 Finance provides flexible budgeting models, real-time monitoring and AI-driven forecasting and analysis tools that help businesses make data-driven financial decisions.

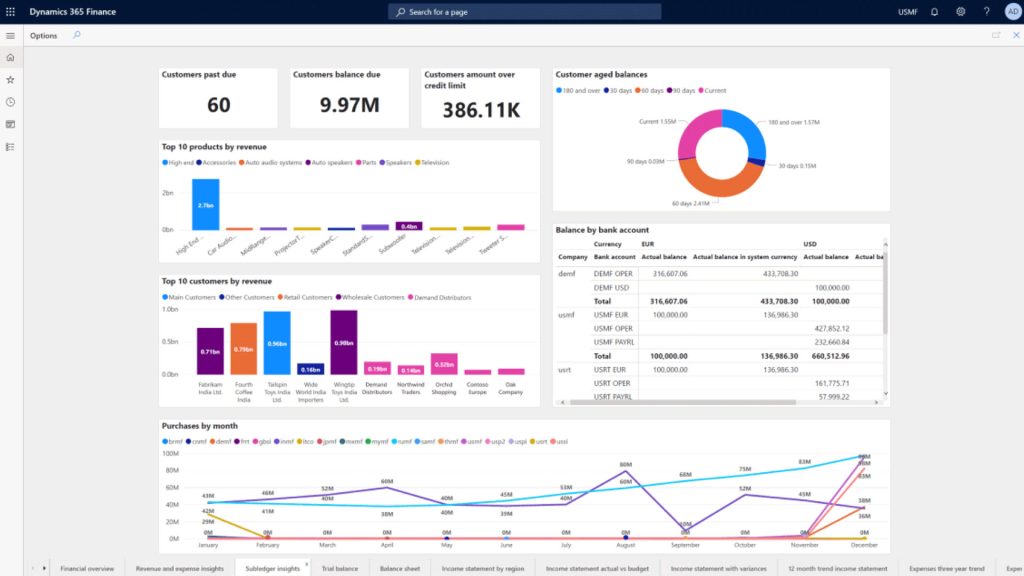

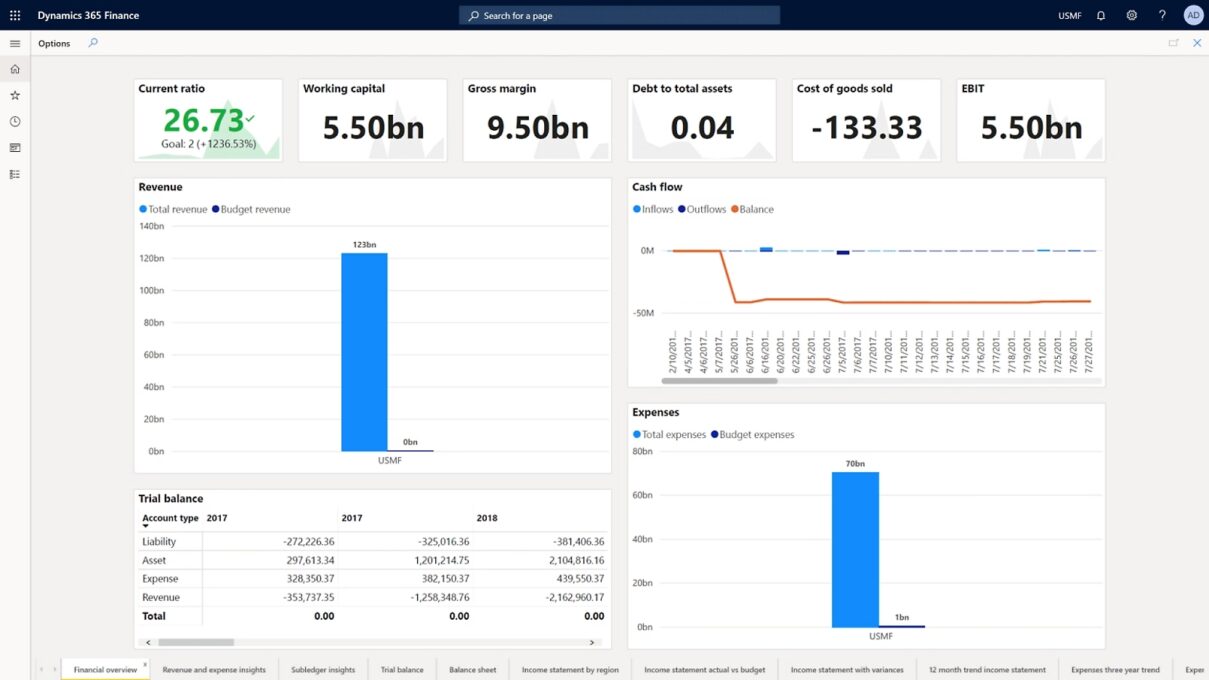

Financial Reporting and Compliance

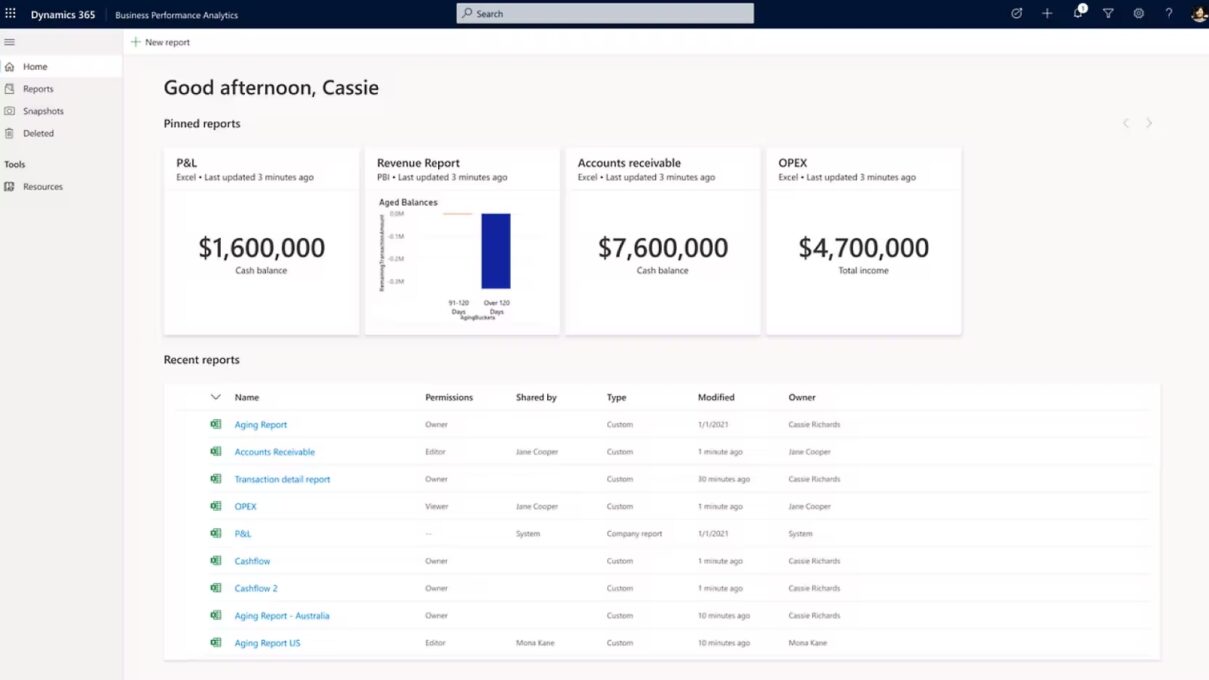

Financial reporting and compliance are critical for businesses to maintain transparency, meet regulatory requirements and make informed decisions. Microsoft Dynamics 365 Finance offers advanced analytics and business intelligence reporting tools with Power BI integration, built-in compliance features for various industries and regions and AI-driven insights to help organizations stay on top of their financial obligations.

Automation and AI-driven Insights

Microsoft Dynamics 365 Finance leverages automation and artificial intelligence (AI) to optimize financial processes, improve decision-making and enhance efficiency.

AI-driven insights and real-time embedded analytics. help finance teams predict trends, reduce errors, and gain real-time visibility into financial health.

Automate and prioritize financial tasks, including AI-powered cash flow and budget forecasting and anomaly detection, plus automated reconciliations and financial close processes.

Expense Management

Expense management in Microsoft Dynamics 365 Finance helps businesses track, control and automate employee expenses approval workflows while ensuring compliance with company policies.

The module integrates seamlessly with accounts payable, payroll and budgeting to provide real-time visibility into corporate spending.

Globalization and Localization

Microsoft Dynamics 365 Finance is designed to support global businesses by providing multi-country, multi-currency and multi-language capabilities. Decrease global financial complexity with a flexible, guided, rules-based chart of accounts and dimensions.

The platform ensures compliance with local tax regulations, financial reporting standards, and business practices across different regions with country-specific localizations and multiple legal entities.

Seamless Integration

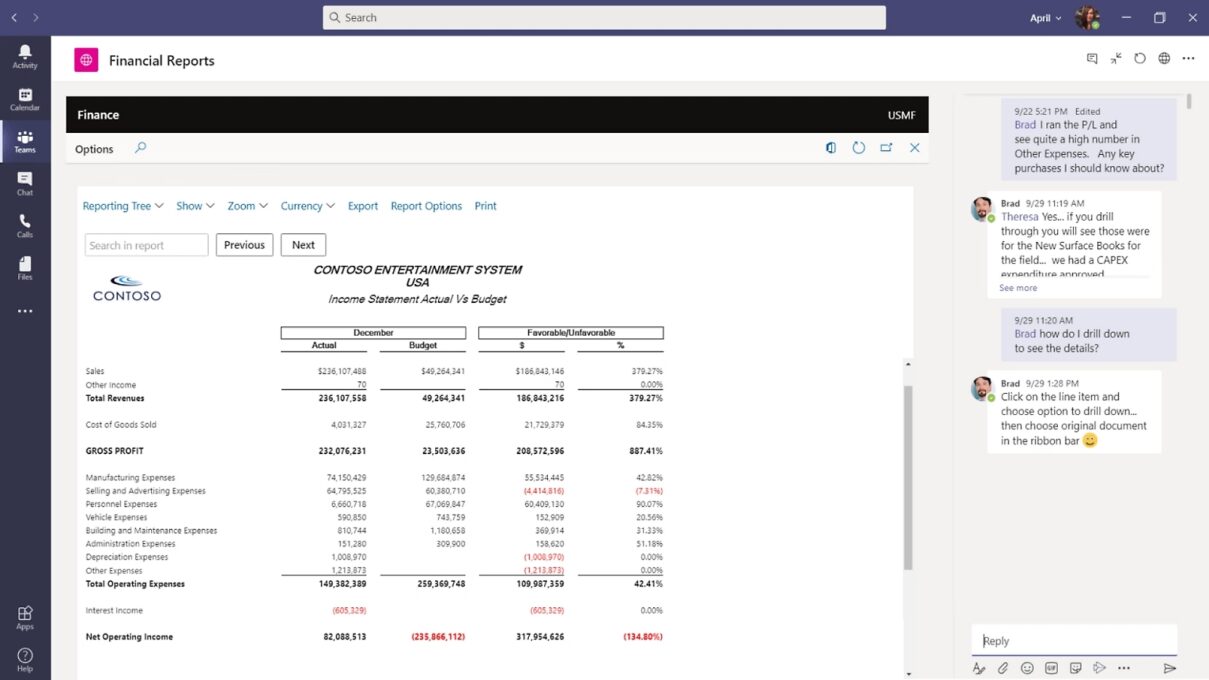

Microsoft Dynamics 365 Finance is built to integrate with various Microsoft and third-party solutions, enabling businesses to connect financial data, streamline processes and enhance decision-making. The system unifies and automates financial processes by supporting real-time data synchronization, automation and AI-driven insights for a fully connected enterprise ecosystem on Microsoft Azure.

Connectivity with Microsoft 365, Microsoft Power BI, Microsoft Teams plus other Dynamics 365 applications such as Supply Chain Management, Project Operations, Sales and Human Resources.

FEATURES – Microsoft Dynamics 365 Finance

AI and Copilot in Microsoft Dynamics 365 Finance

Copilot in Microsoft Dynamics 365 Finance is a set of AI-powered tools designed to assist users in completing tasks more efficiently, improving productivity and providing actionable insights across the platform. It is integrated directly into Dynamics 365, helping users by delivering AI-driven suggestions, automating processes and providing advanced financial data analytics.

Collections Coordinator Summary by Copilot

Get an AI-generated summary of a customer’s overdue invoices, payment history, and remaining credit in the Collections coordinator workspace, plus an AI-generated draft of a reminder email.

Customer Page Summary

Get an AI-generated summary of a customer’s account for account status and insights. Copilot draws information from data such as invoices, payments, orders, agreements and rebates.

In-app Guidance and Chat with Data

Provides conversational support to users, helping them work with application functionality and data. Users can ask questions in natural language about finance and operations data for self-service analytics.

AI-powered Reporting and Budgets

Copilot can help generate financial reports and budgets with a few clicks, offering suggestions on what reports to generate based on financial data and business needs.

Automated Task Completion

Copilot helps automate tasks and routine processes like journal entry posting, payment processing, invoice matching, bank reconciliation and invoice approvals.

Predictive Forecasting

Copilot helps create cash flow forecasts, using historical financial data (such as accounts receivable, accounts payable) and predictive analytics to make recommendations.

Prodware Vertical Solutions and Accelerators for Finance and Supply Chain Management

Why choose Prodware?

We are ScoreFact certified on Microsoft Dynamics 365 Finance.

Prodware has worked within the manufacturing, distribution, retail and services sectors for more than twenty years. In addition to our strong customer base over multiple countries we have developed sector-specific solutions and accelerators to complement Microsoft technology to support the strategic and operational needs of finance teams.